Corn, soybean usage cuts overshadow smaller Argentine crops

February 8, 2023

Getty Images

USDA made sweeping cuts to 2022/23 Argentine corn and soybean production that caused global ending stocks for both crops to tighten in today’s World Agricultural Supply and Demand Estimates report. USDA’s downward revisions were higher than the market had been anticipating, but any potential bullish price action was largely offset by cuts to U.S. corn and soybean usage for ethanol and crush processing, respectively.

Wheat crops in Australia, Brazil and Russia were revised higher, but a surge in international purchases from top buyers in the Middle East, Southeast Asia and China helped keep bullish price prospects alive in the wheat complex.

“Argentina’s corn (and soybean) production was the key focus of today’s reports,” according to Farm Futures grain market analyst Jacqueline Holland. “The South American country is the world’s third largest corn exporter but is battling a multiyear, La Niña-induced drought that has largely decimated crop conditions during the current growing season.”

Here are some additional highlights in today’s report.

Corn

UDSA’s latest analysis for corn shows lower ethanol usage and larger ending stocks. Corn used for ethanol fell by 25 million bushels. USDA didn’t note any other usage changes, leaving U.S. corn ending stocks up 25 million bushels to 1.267 billion bushels, which nearly matched analyst estimates. The season-average price received by producers remained unchanged, at $6.70 per bushel.

The December 2022 cold snap and subsequent weekly ethanol production data from the U.S. Energy Information Administration are “not at the level where we expected them to be,” is how World Ag Outlook Board chairman Mark Jekanowski rationalized the pullback.

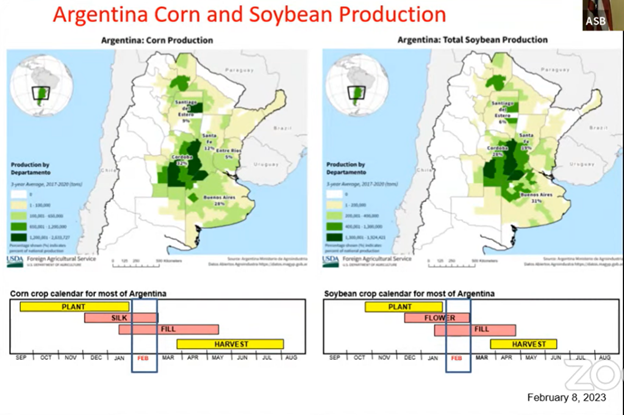

In South America, Argentina’s corn production estimates took a hit, as expected, moving from 2.047 billion bushels in January down to 1.850 billion bushels. That was even lower than the average trade guess of 1.909 billion bushels. Brazilian corn production estimates held steady at 4.921 billion bushels.

“Argentina has a long corn planting window with a long trend of later-planted crops preferred by Argentine farmers,” Holland says. “Despite some recent rains in January, the drought damage remains severe with Jekanowski noting that without that moisture, USDA’s cuts would likely have been more substantial.”

Global ending stocks are on the decline, falling from 11.670 billion bushels in January down to 11.625 billion bushels. Analysts were expecting to see an even bigger dip, with an average trade guess of 11.603 billion bushels.

“Argentina’s smaller corn crop drove decreases in the global corn balance sheet,” Holland says. “Even though USDA’s cuts to Argentina’s corn were substantial, the market only posted minor gains as feed usage declines were posted to account for tighter supplies. For U.S. growers, the smaller Argentine crop means that there may still be some opportunities to cash in on the export market this spring. Even though outstanding export sales are 49% lower than the same time a year ago as China shifts towards Brazil as a primary corn supplier, there may still be some export prospects for U.S. corn exporters if Argentina suppliers can’t fulfill contracts.”

Soybeans

This month’s updates included a lower soybean crush and higher ending stocks. Soybean crush this marketing year is now forecast at 2.23 billion bushels, which is 15 million bushels lower than last month, which USDA attributes to “lower domestic soybean meal disappearance and a higher soybean meal extraction rate.” Ending stocks moved 15 million bushels higher to 225 million, versus trade expectations of 211 million bushels. The season-average price received by producers improved 10 cents from last month, at $14.30 per bushel.

In South America, Argentina’s production estimates took a hit, falling from 1.672 billion bushels down to 1.506 billion bushels. That was an even bigger decline than the trade was expecting, with an average analyst estimate of 1.556 billion bushels. Brazilian production estimates were stable at 5.621 billion bushels and were very close to the average trade guess of 5.622 billion bushels.

“As expected, most of the market price action for the soy complex today was derived from Argentina’s smaller crop,” Holland says. “Dry conditions continue to weigh on local crop conditions, which likely would have been worse without January 2023 rains, according to Jekanowski. Argentina is the world’s third largest soybean exporter and the largest global supplier of soymeal and soy oil products.”

There is still some time for a partial recovery for Argentina’s soybean crop, Holland adds. As La Niña (finally) dissipates over the next few months, Argentina is expected to receive more rain and will likely move out of its drought conditions by late March, according to the Buenos Aires Grains Exchange, she says.

Global ending stocks fell from 3.803 billion bushels down to 3.749 billion bushels, mirroring analyst expectations.

“The global balance sheet shrunk for soybeans, but the smaller supply did not trigger any upward price movement for U.S. soybean futures,” Holland says. “This is largely because usage estimates (crush) in China and Argentina were pared back to account for the scarce supplies and high prices.”

The bottom line?

“U.S. soy growers are enjoying a late-season export surge thanks to harvest delays currently ongoing in Brazil,” Holland says. “This will help keep healthy price competition in the local market for U.S. soybean sellers over the next couple weeks, but after that, growers will be increasingly reliant on crush capacity for cash opportunities in the spring and early summer months.”

Wheat

USDA noted its wheat outlook for February is “largely unchanged,” adding that it made minor revisions to domestic use and ending stocks. Food use is still at a record level of 975 million bushels but did trend 2 million bushels lower from January. Seed usage firmed 1 million bushels to 70 million. Export estimates were left unchanged, at 775 million bushels. Ending stocks increased 1 million bushels to 568 million – analysts expected to see that number increase to 576 million bushels. Season-average prices received by producers faded 10 cents lower to $9.00 per bushel. That’s a record high price for U.S. producers, Holland points out.

“Domestic food usage was trimmed slightly but remains at a record high for 2022/23,” Holland says. “About two-thirds of the 2022/23 wheat crop has been marketed, according to Jekanowski. This should signal to U.S. farmers with unpriced 2022 wheat crops remaining in storage that fewer price opportunities will likely be available over the next two months until export season begins to pick up in early May.”

But the strong global export market could present additional challenges for U.S. growers, Holland adds. A strong dollar and ample supplies across the world mean that a lackluster U.S. wheat export season could be around the corner. So, growers with 2023 crops in dormancy may want to start booking advance sales of at least part of the 2023 wheat crop while prices remain high, she says.

A couple of key global competitors saw their production potential rise this month. That includes Russia, moving from 3.343 billion bushels in January up to 3.380 billion bushels. Australia also received an upward revision, from 1.345 billion bushels last month up to 1.396 billion bushels.

Global ending stocks firmed from 9.861 billion in January up to 9.896 billion bushels in today’s report. That was also higher than the average trade guess of 9.867 billion bushels.

“Australia is harvesting another record-breaking wheat crop this year and will likely have another record-high export season,” Holland notes. “USDA raised Russian wheat production based on lower abandonment thanks to area data from Russian state statistics agency, Rosstat.”